In the article below, we will explain how to configure the taxes in your PrestaShop online store in accordance with the new regulations.

To do so, go to your PrestaShop online store’s control panel and follow the steps shown below.

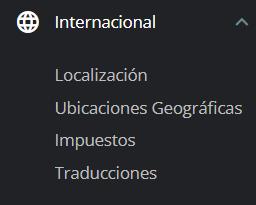

Go to International > Localization.

- In the localization tab, go to Import a localization pack.

- Select the localization pack you want to import by selecting the country. In content to import, only select States and taxes.

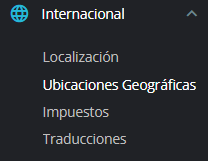

Go to International > Geographical locations

- In the Countries tab here, only activate EU countries and not the non-EU ones. Disable the rest so they don’t appear in the cart.

- Repeat exactly the same thing in the States tab. You can use the filters to help you to activate both the countries and EU and non-EU states more easily.

Go to International > Taxes.

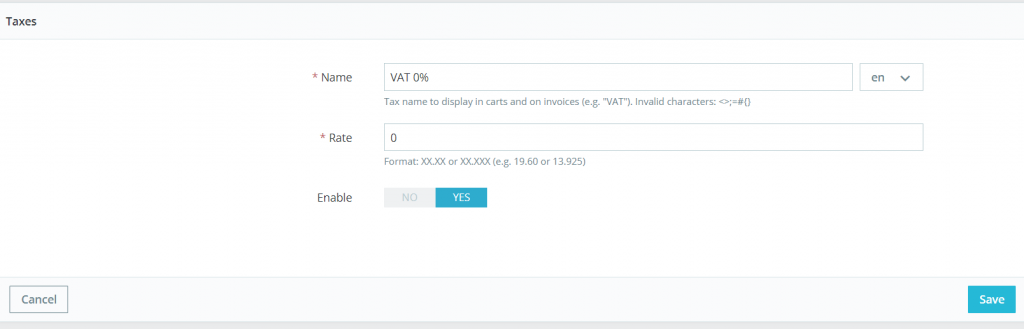

- In the Taxes tab, you need to create the tax VAT 0%, since this will be necessary in order to synchronise with the Multi-Channel Integration Platform. Click on Add new tax. Enter the details and click on Save.

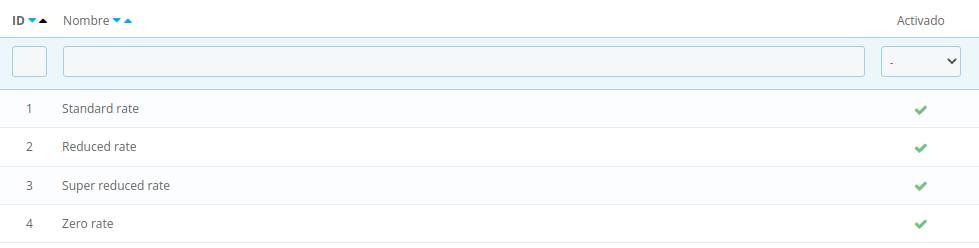

- In the Tax Rules tab, there should be 4 tax rules with the following names:

- Standard rate

- Reduced rate

- Super reduced rate

- Zero rate

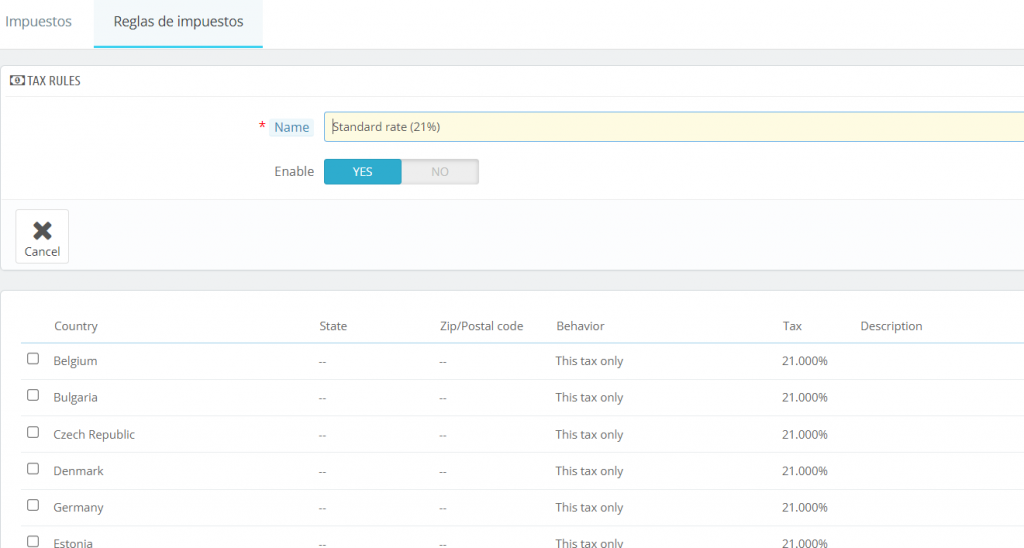

- Within each tax rule, you need to create the tax that corresponds to each country (for cases where the 3 types don’t exist, double the lowest tax or the only tax they have). In the case of the Zero rate tax rule, the VAT 0% tax should be assigned to all countries.

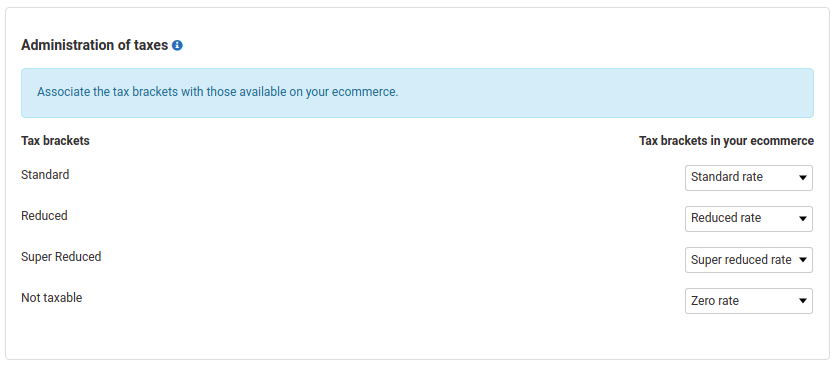

Once this has been done, go to the Multi-Channel Integration Platform to configure these tax rules.

Now you have correctly configured the taxes, you can continue with the rest of the configuration, if required. More information here.

Contact

Contact