Share This Article

The smartphones sector continues to develop at speed, and it is vital for online providers to keep up to date with the latest trends in order to attract and retain your customers. As we move through 2025, identifying the most popular brands and models as well as the most effective sales strategies will be essential for the success on online sales in a sector as dynamic and in demand as the smartphone sector.

Evolution of the smartphone sector in ecommerce (2019-2024)

Over the last five years, ecommerce for smartphones in Europe has gone through various stages:

- 2019-2020: Strong growth driven by the pandemic, accelerating the adoption of online shopping using these devices.

- 2021-2023: Stabilisation after the initial boom from the pandemic, with changes in consumption habits and a highly competitive environment. The global market experienced declines in 2022 before recovering in 2023.

- 2024: First significant increase (+5%) in European shipments after several years of decline, with Samsung reporting a 6% increase in its sales:

- 2025: Consolidation of the online channel for buying and selling smartphones, representing approximately 55% of all ecommerce transactions, with forecasts of sustained annual growth of 7-8%.

Smartphone brands leading the market

At present, Samsung, Apple and Xiaomi hold almost 80% of the European market. Samsung is the top seller in terms of volume and turnover, positioning itself as safe and popular choice in many consumer segments. Apple maintains its appeal for high-end users, although its margins are tighter. Xiaomi is popular due to its excellent quality-price ratio, particularly in markets sensitive to cost. There are other brands outside the top sellers, but which also offer opportunities for your ecommerce. Motorola, TCL and Ugreen are smartphone brands which appear in the TOP8 and, although to a lesser extent, continue to generate demand in the market.

Below is a table showing the most popular brands by European country in 2025.

| Country | Most popular brands in 2025 |

| Spain | Xiaomi, Samsung, Apple |

| France | Samsung, Apple, Motorola |

| Italy | Xiaomi, Apple, Samsung |

| Germany | Xiaomi, Apple, Anker, LG |

| Poland | Xiaomi, Realme, Samsung |

Key models for 2025.

The strategic choice of smartphones for your ecommerce is key for generating sales and growth. Choosing popular models with high turnover and margins is essential to grow in a demanding category. Pricing is a key element to consider for generating interest and increasing sales.

Below we wills show you a list of the most popular models on the BigBuy wholesale portal. You can see the approximate prices but if you want to find out the real prices and margins you can achieve we recommend that you register on our website. It is completely free.

- High-end:

- Apple iPhone 16 Pro Max: leader in the premium segment, price between 1,200-1,400 euros

- Mid-high end:

- Samsung Galaxy S24 FE: high quality at more accessible prices, around 380-500 euros.

- Xiaomi Redmi Note 13: ideal quality-price ratio for increasing volume and profitability.

- Samsung Galaxy A34/A54: good turnover and margins.

- Budget range:

- Motorola G14/G24: very popular due to its lower price, 100-130 euros.

- ZTE Blade A55: cost-effective and functional, key in emerging markets.

Practical advice for online providers in the smartphone category

Here are 5 tips to optimise your online smartphone catalogue. Follow these tips to optimise your sales and stand out from the competition.

- Organise by relevance and demand: Place the most popular models in key positions.

- Professional and up-to-date photos: Show various high resolution images from different angles.

- Clear and detailed information: Provide comprehensive and easy to understand technical specifications.

- Simple visual comparison: Help the user compare models quickly.

- SEO optimisation: Use relevant keywords in descriptions and titles to improve visibility in searches.

How to create the perfect product page for smartphones

- Optimised title: Brand, model, capacity and clearly identifiable colour.

- Attractive visual gallery: High quality images, 360° views and demonstration videos.

- Detailed technical specifications: Operating system, RAM memory, storage, battery, screen, camera, among others.

- Description focused on benefits: Explain how the technical features improve the user experience.

- Customer opinions: Include reviews to increase confidence.

- Cross-selling and Upselling: Suggest related accessories and better models to increase the average ticket.

Immediate actions to maximise results in the category:

- Add key models quickly (Redmi Note 13, Galaxy A34/A54).

- Competitive analysis of premium accessories and their inclusion in the catalogue.

- Remove products with poor turnover and margins.

Medium- and long-term strategies

- Negotiations with providers (Apple, Samsung) to improve margins.

- Create a specific category for star accessories.

- Implement automatic systems to monitor prices and margins by SKU.

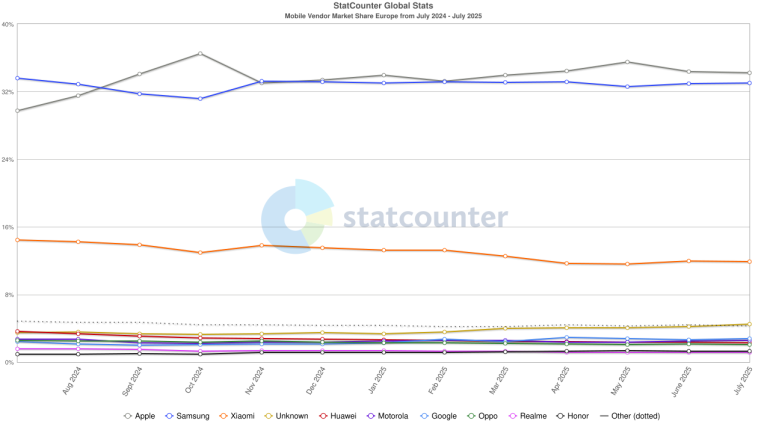

Market share in the European smartphone market (2025)

There is no doubt that the smartphone sector presents clear sales potential. It is a dynamic market with multiple brand categories aimed at various segments, and very dynamic thanks to the advances made in technology by manufacturers.

In 2025, according to data from StatCounter, this is the market share by brand in Europe:

Apple: 34.2%

Samsung: 33.1%

Xiaomi: 11.9%

Google: 2.8%

Motorola: 2.5%

Other: 4.5%

Staying up to date with these trends and using appropriate strategies will allow online providers to consolidate their competitive position in the dynamic European smartphone market in 2025.

Contact

Contact